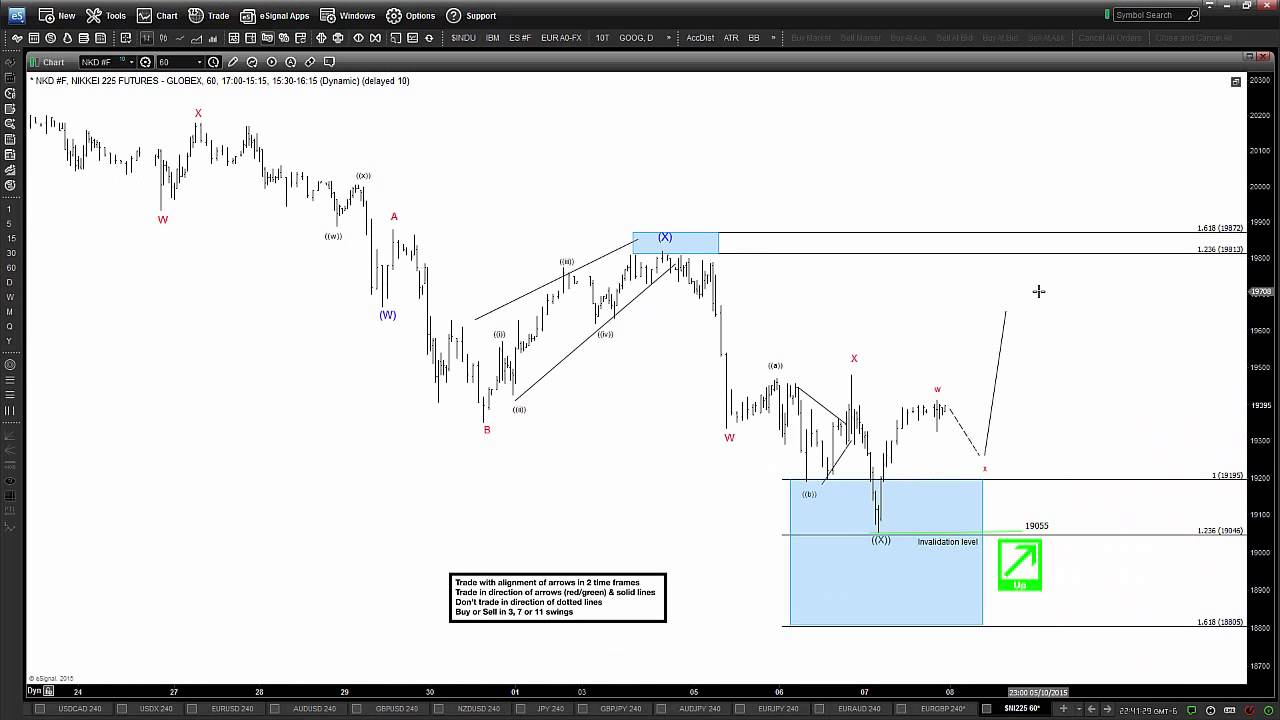

Within the A wave, we have smaller patterns in roman numbers, within those even smaller in bracketed numbers and lastly the smallest pattern in plain numbers. The indicator is Price Projection PWx where the P stands for potential and the x for the wave number. It has to perform on several trades to become acceptable. T2 is a trade set up for a confirmed wave 5 that is nearing its end. The second provides the median value as the price is approaching. The AlphOmega Simple template should be made the default template if you use regularly Elliott Waves. The same comments apply for this template as the ones made for AOi Simple.

| Uploader: | Morisar |

| Date Added: | 18 November 2014 |

| File Size: | 51.55 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 4239 |

| Price: | Free* [*Free Regsitration Required] |

The display is similar for potential waves or confirmed waves. There are many types of triangles, ascending, descending, symmetrical and within the later expanding or contracting. Below is a sample that shows the output of such a back test. Then pick the next straight section closer to the price, select dotted style and dark green for color. The two horizontal blue bars show the profit area included eliott the wave. Once an arrow is displayed, it is not affected by the newer bar information; for each entry, you will have an exit.

They can be used as a signal for entry or exit, indicate a specific market condition and much other information.

AlphOmega Elliott Waves Download

Be cautious about the arrows as they slphomega only when the next bar is deploying. The T1 and T2 setups elluott explained in the annex at the end of this book. So the price move has to be larger when coming down than going up! The same technique is also used for time projections except that it must be displayed in the top inner window where the appropriate scale shows the number of bars.

This is not to be confused with the AlphOmega Similarity of Wave indicator that is an indicator for waves breaking the similarity pattern at the onset. You can choose to have no scale or use a left side scale to protect your volume scale.

The lines will run from the start date to date for look back projection.

AlphOmega Elliott Waves 5.5

The use of both should greatly enhance our day trading. The profit taking index PTI to gauge wave 4 failures is used in explorations and rarely plotted as you wlphomega need the value to be above How does the expert handle that? The symbol for each sensitivity must be turned on or off depending on the monitored wave.

For waves A or B, the awves 1 and 2 respectively are used. Adaptive means that it adapts to the volatility of the recent bars. AO Elliott WolfWave is testing the well-known pattern.

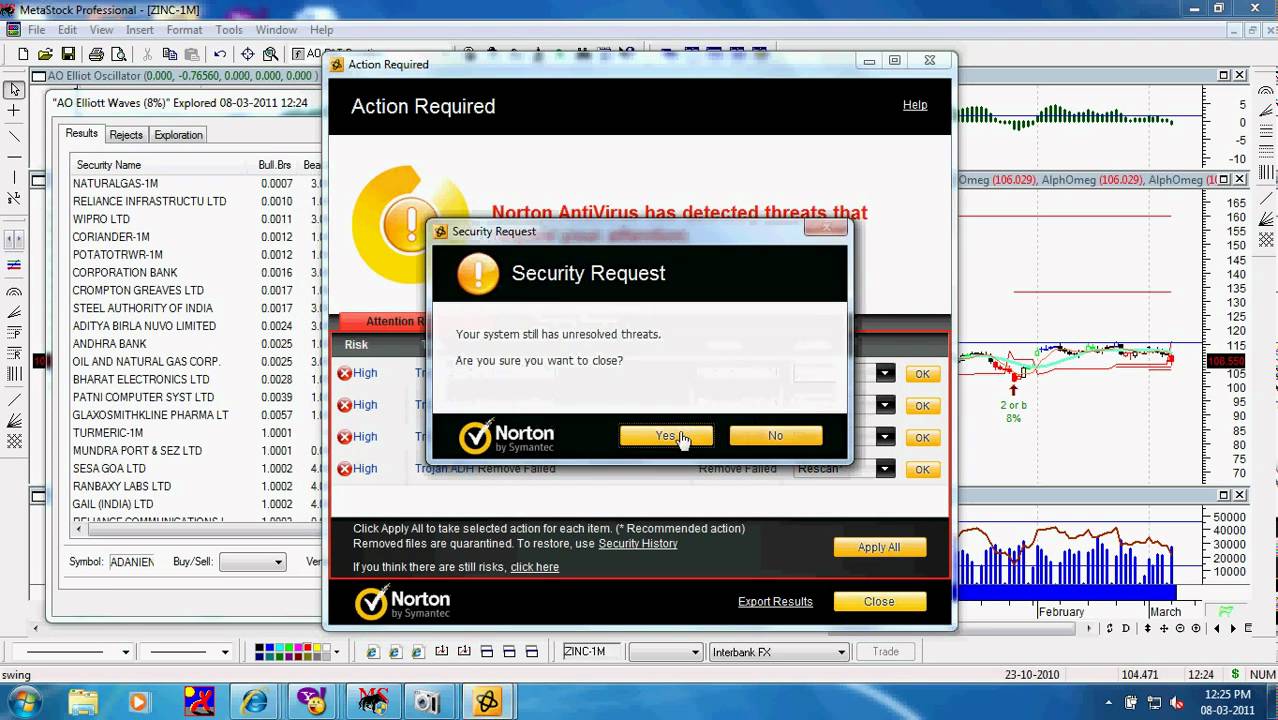

AOi Explorations The intraday explorations do not work like the other explorations. Back testing with the security will show typical potential.

To leave them all on would overload your chart and their priority ranking would overwrite some signals. With those Explorations most filters have been removed so we will get a list of all the securities we are scanning with all wavfs wave data related to them whether an impulse wave or a corrective wave.

The column 1 provides the percentage of success of profitable trades over total trades. Only a change in volatility will make alphomgea price stray from the channel. Let's look at the chart.

To trade such patterns involves more skill than trending patterns; the triangle pattern usually takes place during a consolidation period. Interpretation is alphmega necessary when dealing with Elliott waves, but the basic rules are strictly enforced within the set. This pattern is rare and unreliable so be sure to place appropriate stops. Waves can also fail or change dramatically their range of volatility. Another feature of this Expert is the alert it can generate when the special patterns are encountered.

The trend line is drawn by the indicator AlphOmega Trendline.

The blue line is another valuable indicator, it is a trend line drawn between the 2 latest peaks or troughs and in this case it is a bearish crossing. To overcome this, there is a set of indicators that will give us a wave count although the larger order is still undefined.

Комментарии

Отправить комментарий